The strategic importance of satellite communication, as demonstrated by Starlink during the war in Ukraine, has led to a surge of interest in low Earth orbit (LEO) satellite communication in Taiwan.

The global space industry's output in 2022 is estimated to be US$38.4 billion in 2022, with ground terminals accounting for US$US$14.54 billion - about 38% of the total output. However, In Taiwan, ground equipment accounts for 98.7% of the country's total space industry output of US$7.2 billion.

Indeed, satellite ground equipment has been a major focus of the Taiwan Aerospace and Defense Technology Exhibition (TADTE) 2023 between Sep. 14 - 16. Startups like Tron Future Tech, Rapidtek Technologies and TMY Technology showcased their LEO user terminal solutions alongside Taiwan Space Agency (TASA) - Taiwan's main coordinator of space industry development - which demonstrated its latest progress to independently design and integrate satellite subsystems.

Given Starlink's dominance in the LEO sector and its closed ecosystem stretching all the way to the design and manufacturing of user terminals, Taiwan's ground equipment makers often opt to cooperate with satellite service providers like OneWeb which outsourced its user terminal design and manufacturing.

Rapidtek, an emerging player in LEO satellite user terminal design, is one of those companies making its way into OneWeb's supply chain. A source from Rapidtek indicated that Starlink only sourced components from Taiwanese players and that the profit margin to supply Starlink is often negative. Apart from phased array antennas, Rapidtek also designs antenna control units, radio conversion modules and WiFi access modules on LEO user terminals, while the modems are provided by customers.

Founded in 2015, Rapidtek's primary business lies in providing RF testing service to leading consumer electronics companies like Apple, and only entered the satellite business in 2022. With the consumer electronics sector remaining stagnant, the company sees the satellite industry as a main revenue source in the future.

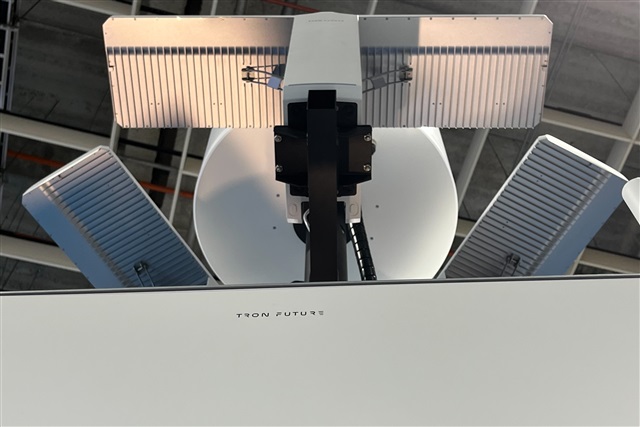

At TADTE 2023, Tron Future also shared its vision for the satellite industry, displaying an integrated anti-drone solution that ultimately seeks to link up its sensors, passive radars and drone jammers with 5G small cells, user terminals and cubesat payloads.

T.SpaceRouter, a lightweight satellite communication terminal based on active electronically scanned array (AESA) technology, is the current main focus of Tron Future, and underpins the company's goal to build a drone defense system hinged on regional private 5G coverage and backed up by LEO satellite communications. Meanwhile, Tron Future's anti-radar system is built on T. Radar Pro, a foldable GaN-based phased array technology with a 5 km drone detection range that is expected to enter mass production in fourth-quarter 2023, and T. Jammer, which is capable of drone remote control and video & telemetry jamming. Notably, the jammer can counter drone swarms with multi-beam jamming ability. Apart from soft-kill option, Tron Future also displayed its T.Interceptor drone featuring an AESA radar seeker and an optical camera seeker.

Finally, Tron Future indicates that its anti-drone solution can also support legacy military communication equipment through customization. For further resilience during wartime, it is also looking into drone-based communications, while working with Taiwan Space Agency on laser-based inter-satellite communication.