To consolidate their position in the Apple supply chain and the OLED market, Samsung Display (SDC) and BOE's patent dispute is escalating by the day. SDC has officially filed a patent infringement lawsuit against BOE in the US, accusing BOE of stealing OLED technology. The technical details and subsequent actions involved in this lawsuit could potentially impact Apple's supply chain.

Photo: The patent war between SDC and BOE is escalating.

Credit: AFP

SDC filed a patent infringement lawsuit against BOE in the district court of Eastern Texas in June 2023. Further reports by South Korea's TheElec revealed that SDC claimed that the OLED products BOE supplied to Apple for the iPhone 12/13 have infringed five SDC patents (599, 593, 803, 683, 578).

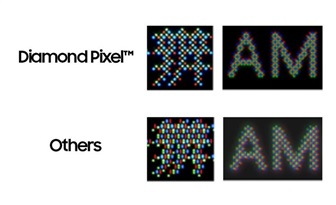

Among the five disputed patents, 803, 683, and 578 are core patents for SDC's "Diamond Pixel," an arrangement structure that consists of red (R), green (G), and blue (B) sub-pixels. In the documents filed for this lawsuit, SDC provided "BOE's OLED RGB sub-pixel arrangement structure" as evidence of patent infringement, pointing out that BOE's arrangement structure is similar to SDC's previously disclosed Diamond Pixel arrangement structure.

Additionally, SDC also claimed in this lawsuit that the OLEDs supplied to Apple by BOE for the iPhone 12/13 have infringed SDC's patent. Considering that BOE has been supplying 6.1-inch OLEDs to Apple since 2020 for the iPhone 12 and subsequently for the iPhone 13/14, all OLEDs supplied to Apple by BOE may be under suspicion for patent infringement.

Back in December 2022, SDC filed a patent infringement complaint with the US International Trade Commission (ITC). Although SDC didn't explicitly mention the name of the company, it was speculated that the complaint was filed against BOE. Initially, SDC only claimed that four patents were infringed but add one more (578) in March 2023. It's worth noting that the five patents SDC claimed to be infringed in this complaint are the same as the ones listed in the Eastern Texas district court lawsuit.

In response, BOE has also begun to take countermeasures. On April 18, BOE filed a lawsuit at the Chongqing No.1 Intermediate People's Court against Samsung China, SDC Dongguan, SDC Tianjin, and Samsung partners in China for patent infringement on nine BOE patents. Additionally, on June 9 and June 21, BOE requested a mistrial regarding three of SDC's patent claims and didn't rule out the possibility of doing the same to the two remaining patent claims in the future.

Since ITC began investigating the patent infringement lawsuit in January, the results of the mistrial request may not affect ITC's investigation. However, if BOE wants to appeal the outcome of the patent infringement lawsuit and ITC's final judgment, the mistrial results can be used during the appeal trial.

Analysis pointed out that the reason why SDC didn't specifically name BOE back in December 2022 was to reduce the impact on Apple's iPhone business. However, with BOE officially filing a counter-lawsuit against SDC and Samsung Electronics in Chongqing, SDC now has a reason to directly file a lawsuit against BOE.

Some viewpoints pointed out that SDC previously had an iPhone OLED supply guarantee contract with Apple. If Apple didn't order a specific amount of iPhone OLEDs from SDC, it was required to pay the difference to SDC. However, this supply guarantee contract ended in 2021. Because of this, SDC is playing the patent card against BOE to prevent the latter from getting more iPhone OLED orders.

Other viewpoints stated that for the patent lawsuit in China, SDC is at a disadvantage against BOE since the latter has a homecourt advantage. Even if SDC wins against BOE in the US case, BOE is likely going to strengthen its patent strategy and portfolio. As a result, BOE could become an even bigger threat to SDC and LG Display (LGD) in the next two to three years.

Currently, the global OLED market is dominated by South Korean companies. According to data from the Korea Display Industry Association (KDIA), South Korea held an 81.3% market share in the global OLED market in 2022, while China accounted for 17.9%. However, when focused on the small-to-medium-sized OLED market, Chinese corporations are rapidly gaining ground. In the first quarter of 2023, SDC held the highest market share of 54.7% in the small-to-medium-sized OLED market. BOE was second at 19.2%, surpassing LGD (17.4%).

The patent dispute between SDC and BOE is also gradually expanding to the supply chain. Recent reports from South Korean media pointed out that Samsung Electronics is planning to exclude BOE from its mobile phone and TV panel supply chain.