According to BusinessKorea reports, for the first time, Apple is buying 3D NAND memory chips from China's YMTC, making it a supplier of components for iPhone 14, which was just launched in its Far Out Event on September 7. Although Apple denied having used YMTC chips in iPhone 14 in a Financial Times report, it has confirmed that it is indeed "evaluating" purchasing YMTC' NAND chips. That is definitely a bad omen for Korean memory manufacturers Samsung and SK Hynix. Why?

From a business point of view, the move gives Apple more bargaining chips in future negotiations with current suppliers. Apple uses many NAND and DRAM memory chips in its smartphones, laptops, and iPads, and usually buys memory from a variety of suppliers, including Kioxia, Samsung, and SK Hynix. Adding YMTC to the list is expected to give Apple more options in terms of specifications, according to tech media Appuals.

Even though Apple said it does not consider selling devices that have YMTC chips outside the China market, the fact that YMTC has strong backings of its government's self-sufficiency policy is even more threatening to SK Hynix and Samsung. It is likely to monopolize the iPhone memory deal in China because Beijing is requiring products that are to be sold in its market to prioritize using components produced by its domestic companies.

"About 60% of South Korea's semiconductor exports go to China every year, in which Samsung's fab in Xian and SK Hynix's fab in Wuxi contribute more than 40% of their NAND and DRAM output," said Colley Hwang, chairman and president of DIGITIMES when giving a lecture on semiconductor industry development and strategy to a class of National Taiwan University students recently. "Of course, South Korea will hesitate in joining CHIP4 – if China decides to boycott Korean chips, Samsung and SK Hynix's operations could be in danger!"

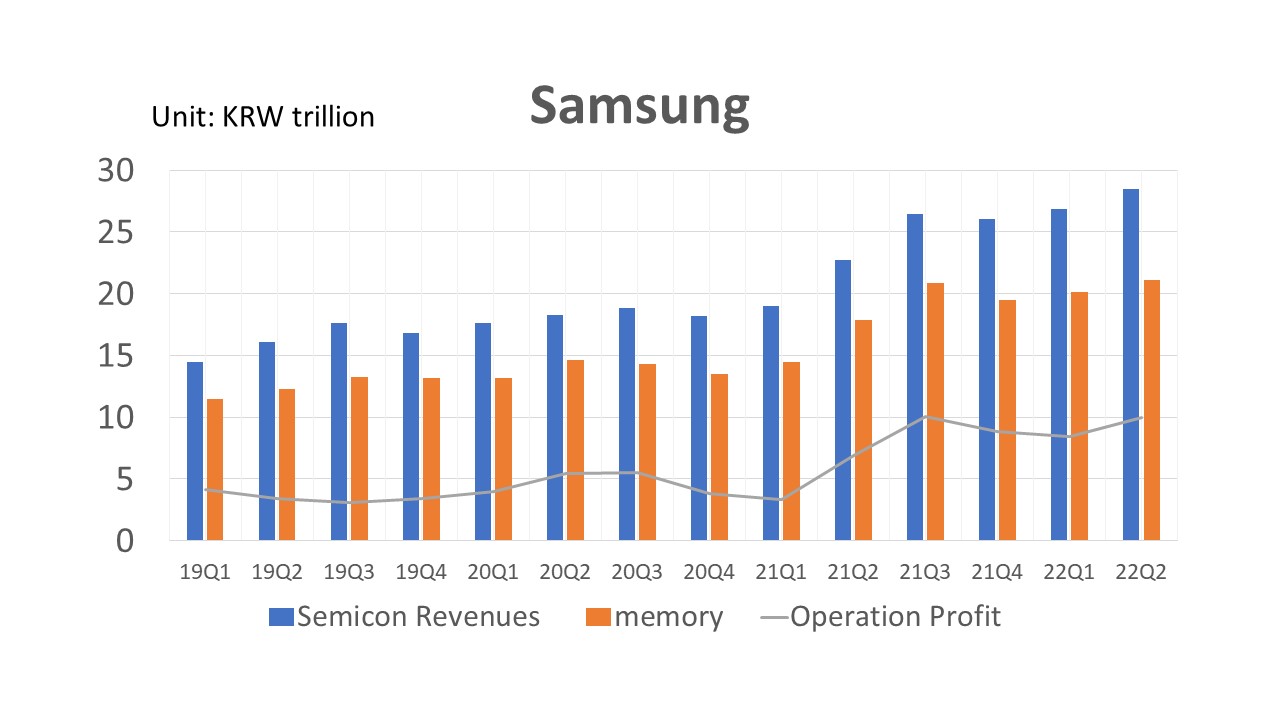

Samsung's semiconductor business contributed to 70.8% of its operating profit in Q2 2022, and memory alone accounts for 74% of the sales in its semiconductor department. SK Hynix, which is an integrated device manufacturer (IDM), has DRAM and NAND products contributing 64% and 33% of its sales, respectively.

With the industry already entering cyclical doldrums due to smartphone and PC inventory readjustment in the consumer electronic sector, having to share Apple's orders with one more competitor is bad news for Korean companies.

Korean chipmakers' over-dependence on memory chips, which are mostly standardized commodity products, is especially vulnerable in the face of increasing competition from YMTC. As YMTC is one of the "local champions" that Beijing is trying to foster, product adoption by Apple would certainly give it a boost in adoption by other companies that are also manufacturing in China.

According to a survey conducted by the Korea Chamber of Commerce and Industry (KCCI), 97% of the semiconductor industry experts who responded to the survey believe the technology of Korean memory manufacturers will be surpassed by China due to US-China competition.

The self-sufficiency policy of Beijing to foster its local companies to gain a competitive edge is often at the cost of foreign companies' limited access to the China market. More than 53% of the US-China Business Council (USCBC) members responded in its 2022 Member Survey that Chinese customers are actively shifting away from American company products or services to domestic or non-American competitors. Chinese companies receive subsidies from their governments that they are able to compete with lower prices.

In the same USCBC 2022 survey, 37% complained about China's protectionist industrial policies having negative impacts on their operations in China, which tripled from the level in 2019.

The tech self-sufficient industrial policy may have been the main reason behind the relatively strong performance of China's semiconductor industry. Despite the global economic downturn amid inflation and geopolitical pressure, China's semiconductor sector logged a 20% YoY surge in net profit in the first half of 2022 to CNY29.9 billion (US$4.2 billion) and a 22% jump in revenue to CNY2 trillion (US$290.6 billion), according to the semi-annual reports released by 102 firms listed in Shanghai or Shenzhen.

YMTC's blitzkrieg tech breaktough

YMTC has just unveiled its fourth-generation 3D NAND chip, the X3-9070, in early August. The product features 232 layers of memory cells, on a par with Micron, which plans to start mass producing its own 232-layer 3D memory chip by the end of 2022.

YMTC also will start mass producing its latest 232-layer chips in December 2022, according to supply chain sources. The fact that YMTC skipped the 192-layer in its original roadmap and directly launched the 232-layer chip was a stunning move for competitors such as Micron, which only had approximately one month to bask in the glory before YMTC's tech catches up with it.

Just as the Biden Administration is imposing export restrictions on advanced semiconductor equipment to China, Apple's decision to adopt YMTC as a supplier certainly has significant meaning in the US-China geopolitical competition.

This new 232-layer chip of YMTC is a six-plane 3D NAND chip, which features YMTC's Xtacking 3.0 architecture and a 2400 MT/S interface speed. It won rave reviews from media such as Tom's Hardware, saying these chips could eventually enable some of the best solid-state drives (SSD).

Samsung Electronics is said to be launching its 8th generation 200-layer 3D NAND chip by the end of the year. Korea industry resources said Samsung has already secured a 256-layer technology through its double-stack approach. Samsung is said to have started mass-producing its 7th generation 176-layer NAND chip in the first quarter of 2022.

Kyung Kyehyun, head of Samsung's Device Solutions Division, which oversees the company's semiconductor operations, was cited by Bloomberg that the outlook for the second half of the year is gloomy, and Samsung is not yet seeing momentum for a recovery next year due to slowing demand.

Samsung announced a US$17 billion investment plan in Texas and laid out potential plans to invest another US$200 billion in the state in July. If Samsung is to apply for subsidies from the US government, it will be required not to make investments in advanced semiconductor manufacturing in China for 10 years. Its competitiveness in the China memory market would not be able to rival YMTC before long.

Source: Samsung financials; compiled by DIGITIMES Asia, September 2022