Foundry service providers have been running at or approaching to full capacity to keep up with demand. Furthermore, they have hiked prices multiple times as chip supply remains uncertain and newly added capacity still lags behind strong market demand.

Their customers are therefore more willing to enter into long-term agreements (LTA) in view of the situation.

They will continue to push advanced process technologies forward while expanding new capacity. Emerging applications including 5G and high-performance computing (HPC) will be among the key growth drivers of foundry service demand.

Introduction

Digitimes Research believes 2021 were a fruitful year for the global foundry industry thanks to strong order momentum on the part of the semiconductor supply chain throughout the year. Foundry service providers have been running at or close to full capacity to keep up with demand. Furthermore, they have hiked prices multiple times as chip supply remains uncertain and added capacity still lags behind strong market demand. Their customers are therefore more willing to enter into long-term agreements (LTA) in view of the situation.

Digitimes Research is optimistic about the global foundry industry's outlook going into 2022. Foundry service providers will continue to push their process technologies forward while adding new capacity. Emerging applications including 5G and high-performance computing (HPC) will be among the key growth drivers of foundry service demand.

The report tracks the development and direction of the global foundry industry 2021 through 2022 from the perspectives of chip supply and demand while presenting an outlook on the global foundry output value and the development of leading global semiconductor players. An examination on key issues affecting the global foundry industry's development in 2022 and a summary of main observations on the global foundry industry's development in 2022 are also set forth in the report.

Foundry demand

Smartphone chip demand

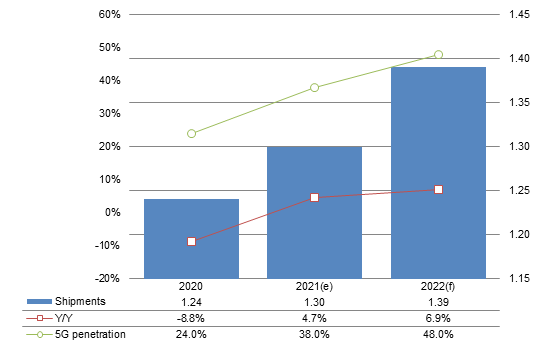

Global smartphone shipments plunged more than 8% in 2020 from the 2019 level as governments around the world implemented lockdowns in response to the COVID-19 outbreak, which took a heavy toll on economic growth and consumer spending. The US government's sanctions against Huawei affecting its 5G development also put a dent in global smartphone shipments.

However, after the US government's sanctions left Huawei with no choice but to slow down its 5G business development, rival smartphone brands began to aggressively ramp up orders for smartphone chips and components in third-quarter 2020 in an effort to grab Huawei's lost share of the 5G phone market. This fueled the rapid growth in global semiconductor demand.

It is noteworthy that with lockdowns being lifted in Europe and America starting third-quarter 2020, the automotive market was recovering and automakers that reduced chip orders in view of the pandemic began to pick up their order momentum. However, a large part of available foundry capacity was already booked by smartphone makers with strong demand. Automakers were unable to get their orders fulfilled and began to see short supply of automotive chips.

As such, the global semiconductor market started to experience a chip shortage in second-half 2020, with no sign of easing going into 2021.

Based on Digitimes Research's estimates, 2021 global smartphone shipments are set to top 1.3 billion units, representing 4.7% growth from 2020, but the projection was adjusted downward from the forecast given in early 2021 in view of the chip shortage and COVID-19 resurgences. Looking into 2022, with COVID-19 vaccination rates on the rise worldwide and the chip shortage to somewhat ease, 2022 global smartphone shipments are expected increase 6.9% to challenge the 1.4-billion-unit mark. This will be a key growth driver for foundry demand.

It should be noted that smartphone makers have been strongly promoting 5G phones since the kickoff of 5G commercialization in 2019. With their efforts, 5G phone penetration continues to climb. Digitimes Research projects that 5G phone penetration will surge 14pp in 2021 from a year ago to reach 38% and have a chance of challenging the 50% mark in 2022 with smartphone makers continuing to bring 5G phones on the market.

Chart 1: Global smartphone shipments and 5G model share, 2020-2022 (b units)

Source: TSMC, compiled by Digitimes Research, December 2021

An examination on the usage of radio frequency (RF) devices and antenna modules in 5G phones will shed light on the importance of 5G applications to foundry demand. Digitimes Research's statistics show that 5G phones use a significantly larger quantity of radio frequency front-end modules (RFFEM) and antenna modules than 4G phones.

About three to five RFFEMs are used in a 4G LTE phone but five to seven are needed in a 5G phone. Moreover, to support the increase in 5G spectrums and frequency bands, more devices are used in a 5G RFFEM. For example, a 5G RFFEM uses double the quantity of filters and RF switches that a 4G RFFEM uses and requires more power amplifiers (PA) and antennas as well.

Furthermore, a smartphone supporting mmWave 5G requires two to three mmWave antenna modules with complete RF circuits, which means it uses even more RF devices than a sub-6GHz 5G phone. As such, the rapid increase in the penetration of 5G phones with a high silicon content translates into growth in semiconductor demand and then foundry demand.

Source: Digitimes Research, December 2021

Chip demand from digital transformation

Digital transformation is not a new trend but COVID-19 is accelerating digital transformation into our daily lives.

Specifically, digital transformation focused on e-commerce activities before COVID-19. Lockdown measures in response to the COVID-19 outbreak spurred needs for working-from-home (WFH), learning-from-home (LFH) and virtual events while fueling the demand for notebooks, cloud computing as well as servers and the semiconductor they use.

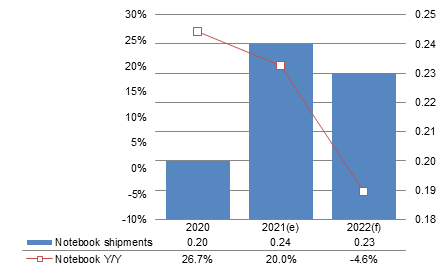

Digitimes Research's statistics show that 2020 notebook shipments amounted to 200 million units, soaring 26.7% year-over-year. With COVID-19 resurgences in 2021, notebook shipments are expected to further grow 20% to come to a new high of 240 million units.

However, Digitimes Research believes 2022 notebook shipments will decline 5% from the 2021 level mainly as COVID-19 gets contained with increasing vaccination rates, leading to a decrease in WFH and LFH needs. Nevertheless, the semiconductor shortage in 2021 also affects notebook shipments. Notebook purchases may get delayed till 2022 so notebook shipments can still top 230 million units going into 2022.

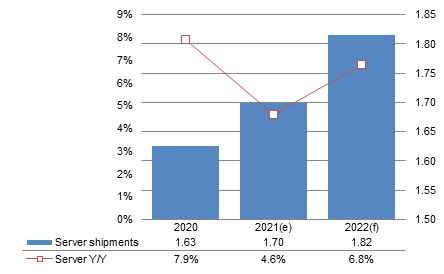

Although server demand is on a rapid rise thanks to brisk online activities during the pandemic, the chip shortage will also put a cap on 2021 server shipments and curtail global server shipment momentum. Digitimes Research forecasts only a 5% on-year growth in 2021 global server shipments. Going into 2022, amid continuing digital transformation activities, increasing datacenter capital expenditures and easing chip shortage, server shipments are expected to climb 6.8%, showing larger growth than 2021.

In sum, digital transformation being accelerated by the pandemic spurs growing demand for notebooks and servers and in turn hoists the demand for chips used in notebooks and servers, including CPU, GPU, AI accelerators and other HPC chips, which will benefit the foundry industry.

Chart 2: Global notebook shipments, 2020-2022 (b units)

Source: TSMC, compiled by Digitimes Research, December 2021

Chart 3: Global server shipments, 2020-2022 (m units)

Source: TSMC, compiled by Digitimes Research, December 2021

In-house chip development trend

Taking CPU for an example. Intel maintains dominating market presence but faces competition from AMD, which is eating into Intel's CPU market share with the support of foundry technology and capacity. On top of that, as Intel struggles to overcome challenges in process technology and production yield, many manufacturers have begun to undertake in-house chip development in hopes of lowering their dependency on Intel while reducing chip costs. Furthermore, in theory, self-developed chips enable the benefits of performance enhancement and software-hardware integration.

Digitimes Research believes Apple has set a good example to those who want to undertake in-house chip development. By launching its M1 chips in 2020, Apple took the first step toward replacing Intel CPU with its self-developed processors. Following the debut of M1X and M1 Max chips in 2021, Apple has plans to introduce new M series processors for use in its own products, leading to a shrinking share of Apple's "Intel inside" products. Worse yet, word has it that Apple may begin in-house development on server CPUs, which would be adding fuel to fire to Intel.

Aside from Apple, more vendors are looking to develop their own processors to replace Intel CPUs or to compete against Intel. For example, datacenter operators Google, Amazon, Microsoft as well as GPU developer Nvidia and startup Ampere Computing are venturing into the server CPU market. In the notebook processor segment, Microsoft, MediaTek and Qualcomm are working on Chromebook CPUs. In general, those endeavoring on CPU development have one thing in common - they all rely on the support of foundry technology and capacity.

Some vendors are working on the development of other chip solutions. For example, Tencent and Alibaba are making effort toward AI chips while Xiaomi and Oppo are developing image signal processing (ISP) solutions. The foundry industry will play an increasingly vital role in driving these advances and the rise of the in-house chip development trend is set to become another key growth driver for foundry demand.

Table 2: Players in the PC CPU market | ||

Company type | Company name | Owing fabs |

Key players | Intel | Yes |

AMD | No | |

Newcomers | Apple | |

Amazon | ||

Ampere | ||

Microsoft | ||

Nvidia | ||

MediaTek | ||

Qualcomm | ||

Source: Digitimes Research, December 2021

Mid- to long-term semiconductor demand

Communication of 5G will play an instrumental role fueling mid- and long-term semiconductor demand. Specifically, the three major types of use cases enabled by 5G communication include Enhanced Mobile Broadband (eMBB), Massive Machine Type Communication (mMTC) and Ultra-Reliable and Low Latency Communication (URLLC). They not only spur burgeoning communication applications but also accelerate the increase of automotive, IoT and HPC applications.

In terms of communication applications, aside from the increase of chips used in 5G phones, the contribution from 5G communication to foundry demand further comes from the needs to upgrade existing 4G base stations, build new 5G base stations and widely deploy 5G mmWave small cells.

As 5G communication enables machine-to-machine (M2M) connection, communication and collaboration, there will be increasing demand for RF, AI and machine learning (ML) chips from IoT applications such as wearable devices including wireless Bluetooth earpieces, smart glasses, smart watches and wristbands, smart home applications including smart TV and smart speakers, smart city solutions including smart street lamps as well as smart water and electricity meters and smart factory applications.

In the automotive sector, not only has the growing digitization trend boosted the demand for automotive chips, but the availability of in-vehicle infotainment (IVI) systems has also brought about burgeoning in-vehicle media and entertainment applications and fueled the demand for the semiconductor chips they use. On top of that, 5G communication promising higher transmission speed and lower latency will help the development of ADAS, autonomous driving and V2X and bring them closer to reality. Semiconductor chips will continue to play an instrumental role in the advances of new automotive technologies and applications.

As to HPC applications, digital transformation activities and 5G-enabled networking activities (including 5G communication, M2M and V2X) all require large amounts of data to be computed or processed. That is, the needs for more datacenters, cloud/edge computing and AI/ML applications as well as related hardware will drive growth in semiconductor demand.

Source: Digitimes Research, December 2021

Summary

The chip shortage that started in 2020 extends into 2021 with no sign of easing. On top of that, the pandemic accelerating digital transformation, the in-house chip development trend taking shape and new 5G-enabled applications starting to boom all drive continuingly strong chip demand, which will fuel the growth momentum of foundry demand 2021 through 2022.

Although some segments (for example, notebooks) may experience on-year shipment decline in 2022, mid- and long-term semiconductor demand will keep foundry demand in high gear.

It is noteworthy that integrated device manufacturers (IDM) increasingly outsourcing their production is also a major factor driving foundry demand in recent years. Based on Digitimes Research's observations, IDMs currently outsource about 20% of their production and will keep hiking the ratio with continuing chip upgrades.

Semiconductor manufacturing is fundamentally capital intensive with the amount of capital investments rapidly increasing along with process technology advances. In consideration of the production scale and technology requirements, few IDMs are willing to make the investments so they mainly focus production on 40nm and more mature process nodes.

In comparison, foundry service providers benefit more from economies of scale than IDMs thanks to their diverse customer base and the booming development of the IC design sector. Moreover, by engaging in joint chip R&D with customers, they get to refine their process technology and shorten their learning curve. Having a large customer base also helps foundry service providers accelerate their return on investment (ROI). Accordingly, when IDMs need to produce chips on advanced process nodes, they tend to outsource production to foundries, the costs of which are even lower than making chips on their own.

Note: The more stars, the higher the influence. ↓ indicates negative influence, ↑indicates positive influence.

Source: Digitimes Research, December 2021

Foundry supply

Capacity

The above analyses on foundry demand show that semiconductor demand remains steady. The capital intensive foundry industry needs to expand capacity to keep up with the strong semiconductor demand arising from flourishing new applications and increasing silicon content in electronic devices and machinery equipment.

In general, foundry service providers all had plans to expand capacity somewhere in the range between 4% and 42% in 2021. Their plans largely focused on adding the capacity of 12-inch wafer production. For one reason, 8-inch wafer production equipment is not readily accessible and is more costly. For another reason, it is more effective to produce most chips on 12-inch wafers and this has become a definite trend with the advances of process technologies. As such, foundries are more inclined to opt for 12-inch capacity expansion.

For some analog ICs or low-end logic chips, the sweet spot is still to produce them on 8-inch or smaller wafers. In response to such needs, SMIC, VIS, PSMC and DB HiTek have expanded their capacity in this respect while TSMC, Samsung Electronics and UMC increase their 8-inch wafer output by de-bottlenecking.

On the premise that foundry demand remains in high gear in 2022, Digitimes Research expects all foundry service providers to stick to their capacity expansion strategies and raise their capacity in the range between 5% and 20%. This goes to show that foundry service providers are optimistic toward the mid- and long-term semiconductor demand and are therefore willing to make early investments.

In sum, going into 2022, foundry capacity expansion will focus on 12-inch wafer production. There will be limited increase in 8-inch wafer capacity. SMIC has room to add 20,000 wafers per month in capacity at its Tianjin plant. VIS will add 16,000 wafers per month at its Fab 3 in Taoyuan and 40,000 wafers per month at its newly acquired Fab 5. PSMC and DB HiTek plan to expand their 8-inch wafer capacity but only to a small extent, each to churn out an additional 10,000 wafers.

Source: Digitimes Research, December 2021

Foundry ASP

The global foundry industry has a hard time keeping up with demand amid the chip shortage in 2021. In view of the supply-demand imbalance, foundry service providers have hiked their prices to various extents and at various frequencies – every quarter or every six months. The price increases have generally reflected in their average sales price (ASP).

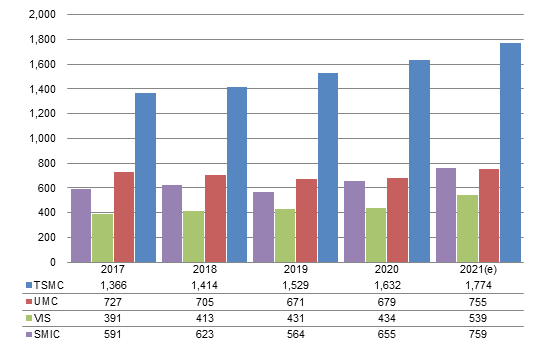

For example, among leading foundries including TSMC, UMC, VIS and SMIC, some saw their ASP go up while the others saw their ASP go down 2017 through 2020. TSMC's ASP maintained steady growth thanks to continuingly advancing process technologies. The others were able to enjoy ASP growth because their new process nodes entered volume production or they optimized their product portfolio.

The ASP growth in 2021 is for a different reason from the past. Digitimes Research believes with foundry supply lagging behind demand, customers are willing to accept foundry price hikes to ensure they are given adequate capacity and chip quantity. This is not the same as the benefit enabled through product portfolio optimization in years past.

UMC, SMIC and VIS have raised their foundry prices more than 10% on average while adding the capacity of their more advanced process nodes. For example, VIS continues to increase the capacity of 0.18um and more advanced processes. UMC has added its 28nm capacity.

These moves on the part of UMC, VIS and SMIC will bring significant growth in their ASP in 2021. As to TSMC, although it announced the price increase in the fourth quarter, the benefit will not manifest until early 2022 as most orders have been negotiated and finalized.

Digitimes Research projects that capacity of advanced process nodes and product portfolio optimization will be the factors leading to ASP growth in 2022.

Although foundry service providers can still take advantage of the supply shortage and raise their quotes, customers may not be as inclined to accept additional increases with the large price hikes already in place in 2021. On top of that, customers may adjust their order strategies in view of some components being in tighter supply than the others in 2022. Only chips that are in shortage have room for price hikes. Furthermore, customers entering into LTAs enjoy fixed foundry prices. This will also put a cap on the extent of foundry price increases.

Chart 4: Key foundry ASP, 2017-2021 (US$/8-inch wafer)

Source: Digitimes Research, December 2021

Advanced nodes

Advanced process technologies play a crucial role in maintaining foundries' competitive edge and revenue growth. In the foundry market today, only TSMC and Samsung Electronics can keep competing in sub-7nm processes. GlobalFoundries and UMC halted their development on sub-7nm processes starting 2017.

Most foundry service providers develop advanced process technologies through collaborations with customers. To them, the collaboration model not only speeds up the development cycle but also guarantees the customers will adopt the advanced process. More than that, by working with different customers at the same process node, foundry service providers can develop multiple versions of process solutions (for example, differentiated versions aiming for high performance or low power consumption) to appeal to more customers and establish economies of scale.

Intel encountered setbacks during the transition to the 10nm node and had difficulty ramping up production. Worse yet, its 7nm process development ran into a wall when incorporating EUV lithography. Intel thus lags behind foundry service providers in terms of fabrication technologies and mass production schedules. To regain its leadership in the foundry sector, Intel announced its IDM 2.0 strategy in March, 2021, with an aim to make a comeback to the foundry market.

Digitimes Research believes Intel is making a comeback to the foundry market because it believes the joint development model between foundries and customers will help it catch up with TSMC and Samsung in the sub-7nm race. Nevertheless, Intel still has some challenges to overcome, such as conflict of interest with customers and access to EUV lithography equipment.

With respect to process technology advances in 2021, TSMC's performance-enhanced version of 5nm technology (N5P) has successfully entered volume production. Samsung has started volume production on its second-generation 5nm node (5LPP) and moved on to its 4nm node (4LPE) by year-end. TSMC's 4nm volume production is scheduled for early 2022.

In contrast, Intel's third-generation 10nm process (Enhanced SuperFin) kicked off volume production in 2021 and was renamed Intel 7 to be put on a par with TSMC's and Samsung's 7nm process. However, Intel 7 went into volume production two years later than TSMC's and Samsung's 7nm process.

Going into 2022, TSMC and Samsung will enter the 3nm race. TSMC schedules 3nm volume production for second-half 2022 while Samsung vows to begin volume production on its 3nm process (3GAE) in first-half 2022.

Despite Samsung's ambition, Digitimes Research believes it will not be able to actually produce 3nm chips until its second-generation 3nm process (3GAP) becomes available in 2023 as it is migrating from FinFET to Gate-All-Around Field Effect Transistor (GAAFET) at the 3nm node.

Intel's original plan to start Intel 4 (formerly its 7nm process) volume production in 2021 is delayed for certain. The current development schedule has volume production penciled in for second-half 2022. The market will not see Intel 4 chips until 2023, which is at least three quarters behind TSMC's and Samsung's 4nm chips.

*Note: Samsung 3GAE will be based on GAAFET architecture, while others except Intel 10nm, 10nm+ and 10nm++ are or will be based on EUV.

Source: Companies, compiled by Digitimes Research, December 2021

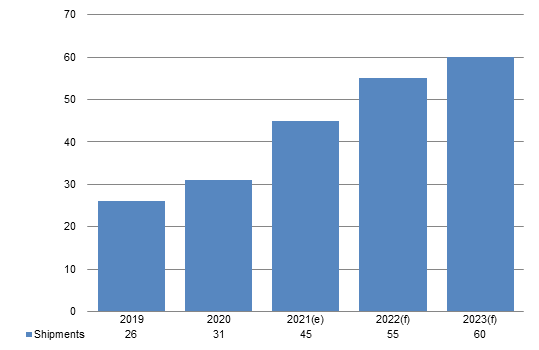

It should be mentioned that EUV lithography plays a vital role in the transition to sub-7nm processes. ASML is the only supplier of EUV lithography equipment in the world so foundries' capacity of advanced processes is largely hinged on how many EUV lithography machines ASML can ship.

According to ASML's statistics, it has shipped an accumulated total of more than 100 EUV lithography systems as of year-end 2020. Among them, 50 were installed at TSMC's fabrication facilities while 20 at Samsung's as of 2020. Based on Digitimes Research's estimates, TSMC will have more than 70 EUV lithography systems as of 2021 as it expands 5/4nm capacity and builds 3nm capacity. Samsung's EUV lithography systems will sum up to nearly 30, still no more than half of TSMC's.

Going into 2022, Digitimes Research expects TSMC to keep adding 4/3nm capacity and thus continue to purchase more EUV lithography equipment. It will have 90 to 100 EUV lithography systems by year-end 2022. In comparison, Samsung will have fewer than 50 systems despite its plan to raise capital expenditure to speed up sub-5nm capacity expansion.

Due to setbacks in its process technology development, Intel lags behind in its EUV capacity build-up so it has even fewer EUV lithography systems installed compared to Samsung.

Table 6: Numbers of EUV equipment owned by TSMC and Samsung, 2020-2022 (units) | |||

Company | 2020 | 2021(e) | 2022(f) |

TSMC | 40-50 | >70 | 90-100 |

Samsung | <20 | <30 | <50 |

Source: Digitimes Research, December 2021

Digitimes Research believes lagging behind in EUV capacity build-up will hurt Intel's competitiveness in advanced process nodes.

Although ASML is making active efforts to ramp up the quantity of EUV lithography systems it can manufacture, the number is still lower than DUV lithography systems. Foundries need to get their hands on a large quantity of EUV lithography systems if they want to build up adequate capacity. However, ASML's projections indicate only a limited quantity will be available worldwide.

Even though ASML has plans to boost EUV lithography equipment shipments 2022 through 2023, Intel will have limited access as TSMC will still own about half the systems installed worldwide while continuing to enhance its EUV lithography process and Samsung will also hike its capital expenditure toward EUV lithography equipment purchases. Worse yet, Samsung, SK Hynix and Micron have plans to incorporate EUV lithography into DRAM production, which will exacerbate the scarcity of EUV lithography systems.

As such, although Intel released an ambitious roadmap in 2021, aiming to roll out a new generation of process node every year, surpass its rivals and recapture its crown in process technology by 2025, its foundry business will be curbed as its limited access to EUV lithography equipment put a cap on its production capacity.

As a matter of fact, Intel and Samsung are both IDMs that also manufacture their own chips. With limited production equipment, allotting capacity to make their own chips means some external orders will not get filled. Intel's ability to take foundry orders will therefore be held back by the lack of EUV lithography machines.

Chart 5: ASML EUV equipment shipments, 2019-2023 (units)

Source: ASML, compiled by Digitimes Research, December 2021

Summary

Continuing capacity expansion to keep up with strong customer demand is a supply-side factor driving foundry business growth and a key point to watch. Specifically, more foundry service providers will focus on expanding the capacity of their more advanced process nodes to not only satisfy customer needs but also optimize their product portfolio, thereby boosting their revenue and ASP.

The chip supply-demand imbalance leads to strong demand for foundry capacity and in turn continuing foundry price hikes, which are the key driver for ASP increases in 2021. Going into 2022, foundry price hikes will still in part contribute to ASP growth, which however will be narrower with customers entering into LTAs.

It should be noted that unstable foundry supply prompted customers to actively ramp up their safety stock. This is a key factor leading to the chip shortage in 2021. The unstable foundry supply was a result of unforeseen events such as natural disasters, extreme weather conditions or fire. On the other hand, the tension between the US and China will only make things worse for the semiconductor supply chain already struggling with a supply-demand imbalance. These are the key points to watch for the semiconductor sector going into 2022.

Note: The more stars, the higher the influence. ↓ indicates negative influence, ↑indicates positive influence.

Source: Digitimes Research, December 2021

Global foundry output value

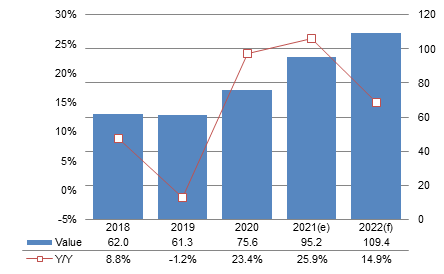

Forecast on global foundry output value

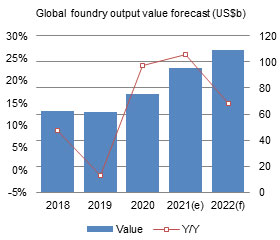

According to Digitimes Research, the global foundry output value is forecast to reach US$95.2 billion in 2021, representing an outstanding growth of 25.9% from the 2020 level despite the high base period a year ago, as the global chip shortage prompts foundry customers to aggressively ramp up safety stock and foundry service providers continue to operate at full capacity even with expansion plans in place.

Looking into 2022, Digitimes Research expects the global foundry output value to break through the US$100 billion mark and even exceed US$110 billion, growing 15% on-year to set a new all-time high.

Chart 6: Global foundry output value forecast (US$b)

*Note: Values do not include those from Samsung System LSI and Intel.

Source: Digitimes Research, December 2021

Overview on top-10 global foundries

The top-10 global foundries' combined 2021 revenue amounts to US$93.64 billion. They represent 98.4% of the market, up 0.9pp from 2020, indicating a growingly higher degree of industrial concentration. Among them, TSMC controls nearly 60% of the market in 2021, securing its championship among foundries.

However, with significant price hikes, foundries are expected to show more than 19% on-year revenue growth in 2021. The top-10 players' average on-year revenue growth is forecast to reach 27.1% with a moderate increase in their market share as well. TSMC, on the other hand, will see its market share fall slightly from the 2020 level even though it announced the plan to raise its price in third-quarter 2021. Digitimes Research expects the benefit to manifest in 2022.

In terms of 2021 revenue rankings, the top-5 remain unchanged. Thanks to price hikes and capacity expansion, VIS will enjoy 40% on-year growth in 2021 revenue, allowing its market share to exceed TowerJazz's. It will move up one place to become the world's No. 8 foundry.

*Note: Revenues do not include those from Samsung System LSI and Intel.

Source: Digitimes Research, December 2021

Digitimes Research projects the rankings among the top-5 foundries in terms of 2022 revenue will stay the same as 2021. Their combined market share will climb from the 2021 level mainly due to a rebound in TSMC's market share.

Going into 2022, TSMC will reap the benefits of the price hikes, capacity expansion of advanced processes, Apple, AMD and MediaTek launching new chips as well as Nvidia and Qualcomm shifting orders for their new GPU and some flagship smartphone processors to TSMC. Its market share will therefore increase from the 2021 level and exceed the 2020 level.

Samsung's market share is forecast to fall moderately in 2022. Digitimes Research believes the decline may be due in part to its orders being divided by TSMC. SMIC's share of markets abroad and its capacity expansion schedule will continue to be dictated by the US government's policy in the midst of the US-China tech war.

*Note: Revenues do not include those from Samsung System LSI and Intel.

Source: Digitimes Research, December 2021

Issues in the foundry industry

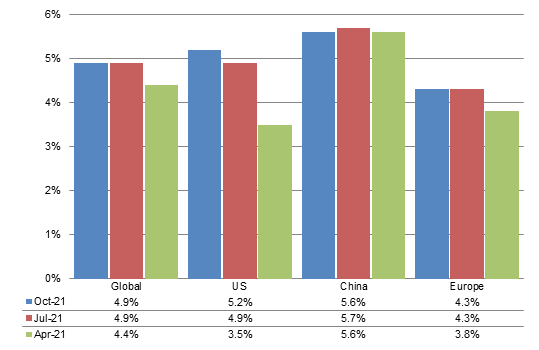

Forecast on 2022 economic growth

According to the forecast by International Monetary Fund (IMF) released in October, 2021, the global economy is projected to grow 4.9% in 2022. The projection was adjusted upward from that given in April, 2021 and stays about the same as that given in July, 2021. This shows that despite COVID-19 uncertainties, increasing vaccination rates around the world will allow the economy to stabilize.

In the October 2021 forecast, IMF revised the outlook on the 2022 US economic growth slightly upward from those given in April, and July, 2021. This indicates thanks to the government's stimulus measures, the US economy is growing stronger than what was anticipated in early 2021. A similar trend is seen in the forecast on the European economy, which is projected to grow 4.3% in 2022, somewhat higher than what was given in the April report but still lower than the global average.

In general, China will be a fundamental growth engine for the global economy in 2022. IMF projects a 5.6% growth in China's economy in 2022. However, the number is revised 0.1pp downward from the December 2021 forecast to be the same as the April projection, indicating a conservative outlook on China's economic growth momentum.

Economic growth affects consumer expectation. People are generally more inclined to increase spending when the economy keeps growing. IMF's forecast implies the global economy still has issues to address going forward into 2022.

For example, although the trillion-dollar infrastructure bill was passed in 2021, the US still faces worsening inflation, which may dampen consumer spending in 2022. The growth momentum and consumer purchasing power of the European economy remains to be watched with the Omicron variant sweeping across Europe. Weak consumer spending in the domestic China market, recent incidents of corporate debt defaults and industrial power supply stability concerns will take a toll on China's economic growth.

Chart 7: Global and key regions economic growth rate, Apr-Oct 2021

Source: IMF, October 2021; compiled by Digitimes Research, December 2021

Foundry supply-side issues in 2022

The semiconductor supply chain sustains impact from the COVID-19 pandemic and US-China tension in 2021. While the global foundry industry benefits from customers aggressively ramping up chip inventory, foundry service providers also have difficulty getting a clear picture of their customers' actual capacity needs. As such, they make careful assessments on customer needs in order to draw up realistic capital expenditure budgets and capacity expansion plans.

Semiconductor supply chain disruptions have also grabbed government attention around the world, especially the situation where the lack of automotive chips is bringing production of vehicles to a halt. Supply chain management becomes ever more challenging when the decision on capacity allocation has to include political considerations.

Worse yet, the foundry industry also faced snowstorms, earthquakes, fires, power outages, material shortage and equipment delivery delays in 2021. These unforeseen incidents may only pose short-term influences but put more pressure on the semiconductor supply chain already dealing with the chip shortage. Foundry service providers are encumbered with the burden to guarantee stable chip supply.

Table 10: Issues affecting chip supply stability in 2022

Source: Digitimes Research, December 2021

Governments around the world are making semiconductor a strategic focus out of technological strength and national security considerations. Geopolitics already plays an influential role on foundry industry developments. This can be seen from the investment planning of TSMC, Samsung, Intel and GlobalFoundries.

For example, following the announcement of its decision to establish advanced process facilities in Arizona in 2020, TSMC further disclosed its plan to set up a fabrication plant in Kumamoto, Japan in 2021 and to expand the capacity at its Nanjing factory. In compliance with the EU's push for regional semiconductor supply chains, TSMC may also have to consider building production facilities in Europe.

In line with the US government's semiconductor policy, Samsung also finalized an investment project in November, 2021 to build its second fabrication plant in the US, which will be located in Taylor, Texas. Digitimes Research expects Samsung's new plant to focus on the production of sub-5nm chips to meet the US government's goals on advanced semiconductor manufacturing.

After announcing its commitment to return to the foundry business in 2021, Intel undertakes the most aggressive planning with geopolitics taken into consideration among the three leading foundries. Aside from adding two new plants in Arizona, Intel has spoken of the goal to build advanced fabrication and assembly facilities in Europe on several occasions and called on American and European governments to provide resources to help Intel reach the goal.

In response to American and European governments' semiconductor policies, GlobalFoundries has also disclosed projects to expand capacity at its plants in Dresden, Germany and New York and to build a new factory in Singapore in 2021. GlobalFoundries is raising the capital needed to build the new facilities through IPO.

The international division of work among the current semiconductor supply chain is the result of several rounds of integration and consolidation but geopolitics is changing the existing supply chain ecosystem. Governments are pushing to build regional semiconductor supply chains out of technological strength and national security considerations although it is costly and defies the principle of comparative advantage to do so. As such, foundries capable of production on advanced processes will find it ever more difficult to keep themselves out of geopolitical influences.

*Note: V* are investments that do not have details confirmed.

Source: Companies, Digitimes Research, December 2021

2022 chip shortage

The ongoing chip shortage that started in second-half 2020 is a result of convoluted factors. Apart from COVID-19, the US government's sanctions against Huawei drive smartphone vendors to aggressively ramp up orders, digital transformation accelerated by the pandemic spurs the demand for notebooks and servers, and automakers joining the competition for chip supply after the automotive market recovery aggravates the chip shortage.

The chip shortage may show signs of easing going into 2022 with the orders for notebook chips weakening. As most supply- and demand-side uncertainties may linger into 2022, Digitimes Research believes the chip shortage will unlikely go away in 2022 but in 2023 instead.

Specifically on the demand-side, innovative technologies such as 5G communication bring about new applications and products, including 5G phones, automobiles, IoT devices, datacenter equipment and edge computing devices. The increase in their availability or their silicon content will drive chip demand. However, foundry customers have been trying to ramp up orders for longer than a year and are adjusting their shipment target downward as some components being in worse shortage than the others prevents them from shipping complete product units. This will prompt the customers to shift their focus to ramping up orders only for chips that are in tighter supply, therefore easing the shortage of the other chips.

On the supply-side, foundry capacity expansion may help mitigate the chip shortage but many chips still rely on production on 8-inch wafers, which is a relatively more mature process. Foundry service providers however largely exert efforts toward expansion of 12-inch wafer capacity. There is yet an effective solution to the mismatch between supply and demand. Even though some chips (for example, PMIC) are gradually migrating to production on 12-inch wafers, it is too slow to meet the urgent needs. Moreover, lingering concerns over foundry supply stability (for example, COVID-19 and geopolitical interferences) also discourage foundry customers from reducing orders too hastily.

Source: Digitimes Research, December 2021

Customer inventory adjustment in 2022

The semiconductor supply chain has been ramping up chip orders for longer than a year since second-half 2020 and suppliers' inventory levels have significantly increased. Maintaining a safety stock helps the semiconductor supply chain cope with chip supply uncertainties in the post pandemic era. However, they cannot keep ramping up orders but will have to adjust their inventory levels at some point. Under the circumstances, foundries face increasing risks when their customers undertake inventory adjustment.

Despite IMF's cautiously optimistic outlook for the global economic growth in 2022, Europe, the US and China each have their own lurking economic troubles to address, for example, COVID-19 in Europe, inflation in the US as well as corporate debt defaults and power supply stab