Thanks to ongoing strong semiconductor demand, the leading Taiwan-based foundries, including Taiwan Semiconductor Manufacturing Company (TSMC), United Microelectronics Corporation (UMC) and Vanguard International Semiconductor Corporation (VIS), generated an aggregated total revenues of US$14.9 billion in first-quarter 2021, up 2.2% quarter-over-quarter.

The strong performance, despite the low season, set a new record. Going forward into second-quarter 2021, the Taiwan-based foundries can expect their revenues to climb even higher, driven by both demand-side and supply-side factors.

In view of the ongoing COVID-19 pandemic and tight semiconductor capacity, the supply chain continued to ramp up chip inventory in first-quarter 2021, therefore pushing the leading Taiwan-based foundries' revenues to grow slightly from a quarter ago and reach a new high. The traditional slow season had no influence on their revenue performance at all.

Introduction

According to Digitimes Research's observation, thanks to ongoing strong semiconductor demand, the leading Taiwan-based foundries, including Taiwan Semiconductor Manufacturing Company (TSMC), United Microelectronics Corporation (UMC) and Vanguard International Semiconductor Corporation (VIS), generated an aggregated total revenues of US$14.9 billion in first-quarter 2021, up 2.2% quarter-over-quarter.

The strong performance, despite the low season, set a new record. Going forward into second-quarter 2021, the Taiwan-based foundries can expect their revenues to climb even higher, driven by both demand-side and supply-side factors.

In view of the ongoing COVID-19 pandemic and tight semiconductor capacity, the supply chain continued to ramp up chip inventory in first-quarter 2021, therefore pushing the leading Taiwan-based foundries' revenues to grow more than 2% sequentially and reach a new high. The traditional low season had no influence on their revenue performance at all.

Based on Digitimes Research's estimates, with the supply chain continuing to ramp up chip inventory, the shipments of new 5G smartphone processors and high-performance computing (HPC) chips on the rise, and foundries expanding capacity and raising prices, the leading Taiwan-based foundries' aggregated revenues will further climb 2% sequentially in second-quarter 2021.

It should be noted that what results in the current chip shortage is quite convoluted and the situation may not get resolved anytime soon. Under such circumstances, the supply chain is expected to continue ramping up chip inventory through second-half 2021, which will benefit the leading Taiwan-based foundries. Digitimes Research has therefore raised the projection on the leading Taiwan-based foundries' whole-year 2021 revenues from US$61.7 billion to US$63.1 billion, representing a nearly 20% year-over-year growth.

Key factors affecting Taiwan's wafer foundry industry

Demand and supply: 2Q21

Amid the ongoing COVID-19 situation and IC capacity falling short of demand, Digitimes Research expects the supply chain to keep ramping up semiconductor orders through second-quarter 2021.

Market demand for smartphone application processors (AP), CPU, GPU, Wi-Fi chips, display driver IC, power management IC, audio codec IC, MCU and automotive chips will remain brisk going into second-quarter 2021.

The production schedule of consumer electronics chips will be more significantly affected by automotive chips in the second quarter than the first quarter.

New 5G smartphones, CPU and GPU entering the market will drive growth in 5G and HPC chip demand in second-quarter 2021 from the first-quarter 2021 level.

Shipments of new 5G phones by Xiaomi, Oppo and Vivo will significantly expand in second-quarter 2021, buoying the demand for chips used in smartphones.

AMD launching new graphics cards will drive growth in HPC chip shipments.

Seeking production capacity, IDM customers including Intel and Samsung Electronics keep placing orders with foundries.

Taiwan-based foundries will continue to expand their 8-inch and 12-inch wafer capacity in second-quarter 2021 to keep up with customer demand.

TSMC's 5nm capacity will increase from 95,000 12-inch wafers to 105,000 wafers per month.

UMC's capacity expansion for its 28nm lines at its Xiamen and Tainan plants will proceed according to schedule.

VIS completed the capacity expansion of its 8-inch fab in Singapore in first-quarter 2021, which will start to generate results in second-quarter 2021.

With capacity supply falling short of demand, UMC and VIS will not rule out the possibility of raising prices again in second-quarter 2021.

Note: The more stars, the higher the influence. ↓ indicates negative influence, ↑indicates a positive influence.

Source: Digitimes Research, May 2021

Demand and supply: 2021

Digitimes Research maintains an optimistic outlook for the Taiwan-based foundries' 2021 revenues.

In view of pending chip shortage, COVID-19 situation, US-China conflict and digital transformation demand, the supply chain continues to stock up on chips. Some vendors chose to enter into long-term contracts with foundries to secure capacity.

New 5G smartphone AP and HPC chips being launched will buoy the Taiwan-based foundries' 2021 shipments.

The new chips include Apple's A15 and M series processors, MediaTek's and Qualcomm's 5G APs, as well as Nvidia's and AMD's HPC chips.

The trend that IDM customers outsource chip production to the Taiwan-based foundries remains unchanged and their demand is expected to increase.

The Taiwan-based foundries plan to expand 8-inch and 12-inch wafer capacity while raising prices.

However, some customers chose to enter into long-term contracts to secure capacity and stabilize prices, which may put a cap on the price increase going forward.

There are some uncertainties that Digitimes Research would like to point out:

Despite government efforts to promote COVID-19 vaccinations throughout the world, there are still uncertainties in regard to pandemic control and challenges in maintaining stability in the economy, consumer spending and chip supply.

Unexpected incidents such as earthquakes and power outages disrupted UMC's and TSMC's production. The water supply shortage also threatens chip production.

Note: The more stars, the higher the influence. ↓ indicates negative influence, ↑indicates a positive influence.

Source: Digitimes Research, May 2021

Taiwan wafer foundry industry

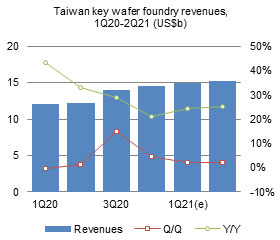

Chart 1: Taiwan key wafer foundry revenues, 1Q20-2Q21 (US$b)

*Note: Taiwan's key wafer foundries are TSMC, UMC and VIS

Source: Digitimes Research, May 2021

The leading Taiwan-based foundries generated an aggregated total revenues of US$14.9 billion in first-quarter 2021, up 2.2% quarter-over-quarter, showing a strong performance despite the low season.

The revenue growth was a result of the supply chain aggressively ramping up chip inventory in view of the ongoing pandemic, continuing digital transformation demand and UMC as well as VIS raising their prices.

According to TSMC, some of its shipments to customers got deferred from fourth-quarter 2020 to first-quarter 2021.

Digitimes Research expects the leading Taiwan-based foundries' second-quarter 2021 revenues to further grow 2% sequentially to reach US$15.19 billion.

Ongoing chip shortage prompting the smartphone and notebook supply chains to keep boosting their chip inventory on top of 5G smartphone processors and HPC chips going on the market will fuel second-quarter revenue growth.

Chip supply will remain tight as foundries re-allocate their capacity originally for consumer electronics chips for automotive chip production.

UMC and VIS are expected to further raise their prices by 5-10% amid continuingly strong chip demand.

Revenues by manufacturing node

Chart 2: Revenue share by manufacturing node, 4Q20-2Q21

*Note: Advanced manufacturing processes are nodes of 28nm and below.

Source: Digitimes Research, May 2021

According to Digitimes Research's observation, the Taiwan-based foundries generated about the same amount of revenues from 28nm and more advanced processes in first-quarter 2021 as the prior quarter.

Due to seasonal factors, both the revenues generated from the 5nm and 16nm nodes and the share showed a slight decline from fourth-quarter 2020.

With Apple's iPhones in transition to the next generation, shipments of the A14 chip made on the 5nm node showed a decline compared to the prior quarter.

Seasonal factors curtailed 4G smartphone AP and Wi-Fi module shipments, resulting in a sequential decline in the revenues from 16/12nm processes in first-quarter 2021.

The share of revenues from the 28nm and 7/6nm nodes exhibited a sequential increase.

Qualcomm's and MediaTek's 5G smartphone AP shipments boosted the share of revenues from the 7/6nm nodes.

AMD's Zen3-based CPU and GPU shipments are expected to continuingly increase, buoying growth in the revenues from the 7nm node.

The revenues from the 28nm node are fueled by increasingly strong demand from IDM customers and smartphone OLED DDI.

According to Digitimes Research's projection, the share of revenues from 28nm and more advanced processes will expand in second-quarter 2021, mainly thanks to the contribution from the 5nm node.

Apple's A15 chip going into volume production will buoy the share of revenues from the 5nm node up 1.5pp from the prior quarter.

The share of revenues from the 7/6nm nodes will still be fueled by increasing shipments of Qualcomm's and MediaTek's 5G smartphone APs as well as AMD's HPC chips.

The demand for the 28nm process remains brisk so the share of revenues is expected to further climb.

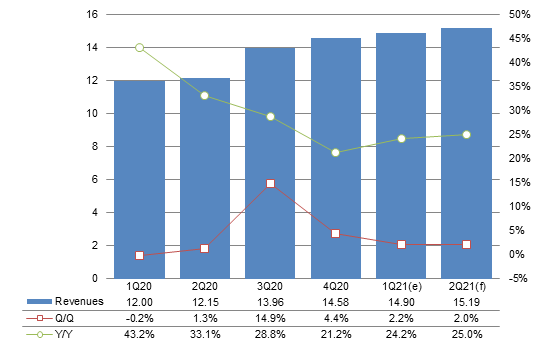

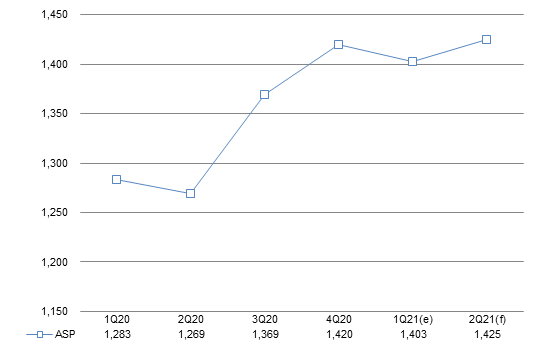

ASP

Chart 3: Taiwan wafer ASP, 1Q20-2Q21 (US$/8-inch wafer)

Source: Digitimes Research, May 2021

According to Digitimes Research's observation, the average selling price (ASP) of the Taiwan-based foundries' wafers fell moderately in first-quarter 2021 from a quarter ago, mainly due to a decline in the revenues from the 5nm node.

A ramp-up in 28nm and 7/6nm chip shipments buoyed the revenues from these process nodes and somewhat mitigated the decline in the overall wafer ASP.

Digitimes Research expects the wafer ASP of the Taiwan-based foundries to reach a new high in second-quarter 2021, amounting to US$1,425.

The increase in ASP will be contributed by a rebound in the share of revenues from the 5nm node and further growth in the share of revenue from the 28nm and 7/6 nodes on top of an enhanced product mix.

UMC and VIS will not rule out the possibility of raising their 8-inch and 12-inch wafer prices.

Annual capex

Chart 4: Taiwan key wafer foundry annual capex, 2017-2021 (US$b)

*Note: Taiwan's key wafer foundries are TSMC, UMC and VIS

Source: Digitimes Research, May 2021

Digitimes Research estimates that the leading Taiwan-based foundries' total capital expenditure for 2021 will reach US$33 billion, soaring nearly 80% from a year ago.

The original forecast was US$28 billion, representing a 50% year-over-year increase.

The leading Taiwan-based foundries announced their plans to increase their capital expenditure in their first-quarter investor conferences taking place starting April this year.

To meet customer demand, they will be further expanding their 7nm, 5nm and 3nm capacity. TSMC has boosted its 2021 capital expenditure from US$25 billion~US$28 billion to US$30 billion.

UMC has added a new project to build its Fab 12A P6 in Tainan, hiking its capital expenditure for the year from US$1.5 billion to US$2.3 billion.

VIS plans to increase the capacity of its Fab 3 in Taoyuan to 8,000 8-inch wafers per month, its capital expenditure for the year climbing from US$180 million to US$300 million.

TSMC and UMC will allocate part of the capital expenditure added in first-quarter 2021 toward capacity expansions planned for 2022 and onward.

TSMC is using its capital expenditure early in 2021 to build its 3nm lines scheduled for volume production in 2022.

UMC is investing into its new Fab 12A P6 in Tainan, which is planned to start volume production in second-quarter 2023.

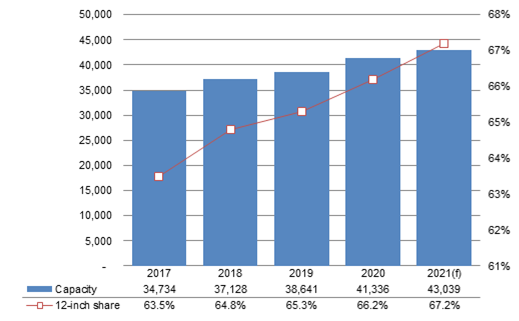

Annual capacity

Chart 5: Taiwan key wafer foundry annual capacity and share of 12-inch capacity, 2017-2021 (k units of 8-inch wafer)

*Note: Taiwan's key wafer foundries are TSMC, UMC and VIS

Source: Digitimes Research, May 2021

Digitimes Research projects the leading Taiwan-based foundries will produce a combined total of 43.039 million 8-inch equivalent wafers in 2021, increasing 4% from a year ago.

Their capacity will expand by 50,000 12-inch wafers and close to 20,000 8-inch wafers.

According to Digitimes Research's observation, capacity expansion by the Taiwan-based foundries will focus on 12-inch wafers. As a result, the share of 12-inch wafer capacity will rise to 67% in 2021.

TSMC and UMC will focus efforts on expanding their 12-inch wafer capacity while moderately adding 8-inch wafer capacity by upgrading equipment or implementing other approaches to eliminate production bottlenecks. VIS, on the other hand, concentrates on adding its 8-inch wafer capacity.

Although TSMC and UMC are aggressively adding capital expenditure to expand capacity, the benefit will not manifest until 2022 at the earliest.

Annual revenues

Chart 6: Taiwan key wafer foundry annual revenues, 2017-2021 (US$b)

*Note: Taiwan's key wafer foundries are TSMC, UMC and VIS

Source: Digitimes Research, May 2021

Digitimes Research raised its estimate on the Taiwan-based foundries' 2021 revenues to US$63.17 billion, soaring 19.9% from last year.

The previous forecast was US$61.7 billion, a 17.1% year-over-year increase.

The supply chain continues to stock up on chips amid COVID-19 uncertainties. On top of that, rebounding automotive semiconductor demand also makes the global chip shortage worse.

UMC and VIS will enjoy growing revenues as they hike prices in 2021.

Digitimes Research expects 8-inch wafer prices to go up 10-20% and 12-inch wafer prices to go up 5-10%.

The chip shortage occurs for complex reasons, which the supply chain will cope with by keeping ramping up chip orders through second-half 2021.

In view of continuingly strong demand, TSMC has raised the projection of its 2021 revenue growth from 14%~16% to 20%,

Aside from expanding the capacity at its Singapore plant, VIS further plans to add 8-inch wafer capacity at its Taoyuan plant to meet brisk customer demand. The added capacity is expected to come online starting second-half 2021.

Both UMC and VIS expect to maintain high capacity utilization throughout 2021.

The Taiwan-based foundries can reach 90-95% capacity utilization based on Digitimes Research's estimates.