Global large-size LCD panel shipments will slip at a CAGR of -0.3% 2020 through 2025 mainly due to saturating demand for TVs, monitors (including AIO PCs), notebooks and 9-inch and above tablets.

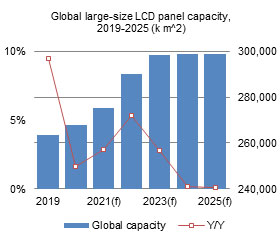

China's two leading panel makers BOE and CSOT are expected to control close to 49% of global LCD panel capacity by 2025 and dominate the panel supply industry, pushing Taiwan-based panel makers to focus on securing their market shares.

However, global small-to-medium-size LCD panel shipments will increase at a CAGR of 0.14% 2020 through 2025.

Although panel demand from the smartphone industry will recover in 2021, factors such as tablets turning to adopt large-size panels, shrinking demand for digital cameras and smartphones turning to feature AMOLED panels, will make panels used in automotive and IoT applications the main growth drivers for global small-to-medium-size LCD panel shipments from 2022 onwards.